Investment Banker

Entry Level Qualification

Graduate

Career Fields

Banking & Finance

For Specially Abled

About Career

PARTICULARS | DESCRIPTION |

Name | Investment Banker |

Purpose | Advise Businesses And Governments |

Career Field | Banking & Finance |

Required Entrance Exam | CAT, CUET UG, SBI PG |

Average Salary | 200000 - 1200000 Rs. Per Year |

Companies For You | Citigroup, Barclays, HSBC & Many More |

Who is Eligible | Graduate |

As an investment banker, you would be working with individuals, corporate and government entities while providing them financial advice about investments. Like, you will tell them where to invest money. Which share, stock or any other financial investment is more likely to give better returns. Apart from financial advice, there are several other wide ranges of services that you will provide as an Investment Banker. You will help an organization raise funds or capital; you will also study the risk involved in investments. You will endorse securities, facilitate mergers and acquisitions, maintain dealer and broker relationship, issuing stocks.

Now let’s understand what they all mean. Endorsing securities mean that when a company wants to raise money, they need to trade it for something (called as security here). Now as an investment banker, you will determine who much money this company can get for this security. Like, they might sell their shares to get funding, so Investment Bank helps them in the pricing of the share. Mergers and acquisitions are when two companies merge into one or one company buy the other, again here investment bank will help them decide that is the value of each company (in the merger) or what is the value of a company that will be acquired. Sometimes, Investment Banks buys securities for their clients; this job is known as dealer-broker job. Thus, they also maintain this role. The investment bank also helps an organization in selling its securities that they have issued for raising funds. This functionality of the Investment Bank is known as issuing stocks.

You will be primarily working on either buy side or sell side.

Sell Side: In the sell side, you will be working primarily with investment banks, commercial banks, stock brokers, market markets, etc. You will keep track of the stocks, the performance of various companies, project their future financials, create research and recommendation and give it to your clients, public, government, etc. You give an idea about what and where to invest.

Buy Side: In the buy side, you will be working primarily with asset managers, hedge funds, institutional investors, retail investor, etc. You will use ideas given by the sell side, and thus make necessary measurements to make investments in probable high rising institutions, stocks, etc.

Key roles and responsibilities

As an Investment Banker, depending upon your profile and specialization, your duties and responsibilities will vary.

In the credit side: This side of Investment Bank works on calculating the creditworthiness of a business. Creditworthiness means if they take money or loan, how likely are they to return back the loan.

You will complete review and challenge activities in a timely manner. You will also do expected credit loss analysis. You will be required to identify themes across the whole risk portfolio. You will be assisting in making strategic decisions to your client. You will prepare all necessary documents, decks, and present to your team. You will ensure that all queries raised are solved in a timely manner.

In risk side: This side of Investment Bank works on calculating the risk of any business. It means how risky it is to invest in the business.

You will set up, lead and develop the centralized risk model confirmations team. You will make sure that all model confirmations are carried out in line with organization policies and guidelines. You will share the confirmation results with your internal team.

If you are working as a sales manager (investment banking service):

You will work to acquire more customers for wealth management & Retail products. You will generate revenue by selling Mutual Fund, Portfolio Management Services, Private Equity Products, Bonds, Structured Products, Life Insurance, General, Motor & Health Insurance, Loan Products, Real Estate & Direct Equity. You will call potential clients and customers through phone, email, etc. You will fix an appointment with them and meet them. You will produce all guidance and advises to new as well as existing customers in financial portfolio management. You will ensure that all regulatory & Company Policy is in compliance.

Portfolio side: This side of investment bank helps clients (individual or business) make an investment in a group of assets instead of any one asset.

You will be responsible for providing all kinds of Financial Planning (FP) and Portfolio Services. You will execute transactions post FP and maintain this as a regular step. You will manage all quarries related to private wealth, PMS and AIF find. You will provide all kinds of Managing Information System reports as and when required. You will develop all kinds of sales strategies for the wealth management business in line with organisation goals and strategies. You will create a standardized sales process to ensure quality control and efficient customer service. You will also achieve a balance of revenue streams through the sale of wealth management which will build a steady annuity flow and through all other asset class. You will maintain strong client servicing and client engagement parameters and thus enhance market credibility. You will keep exploring and learning to be better equipped than competitors. You will closely observe, evaluate and monitor the client positions, portfolio allocations and ensure that they fall within risk and advisory parameters as laid down by Risk, Compliance and Research Teams.

Career Entry Pathway

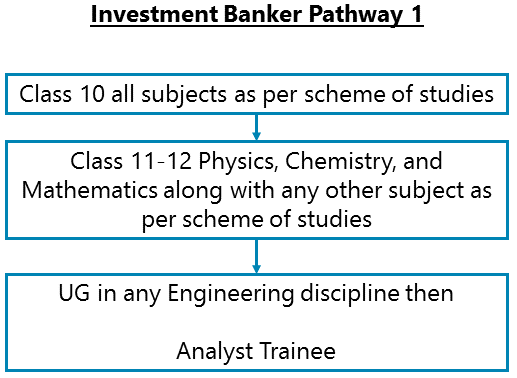

Class 10 all subjects as per scheme of studies – Class 11-12 Physics, Chemistry, and Mathematics along with any other subject as per scheme of studies – UG in any Engineering discipline – Analyst Trainee

After your Class 11-12 Physics, Chemistry, and Mathematics along with any other subject as per scheme of studies, study for an engineering undergraduate degree. After graduation from Engineering, you can apply for the role of Analyst in Investment Banks

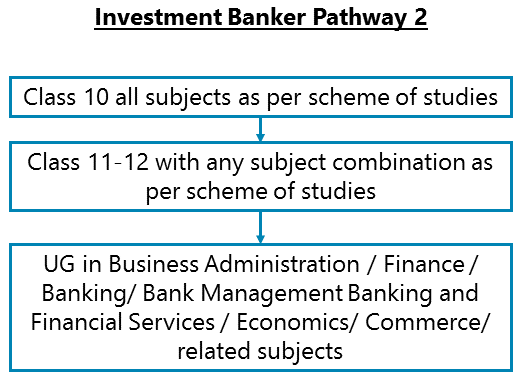

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies – UG in Business Administration / Finance / Banking/ Bank Management Banking and Financial Services / Economics/ Commerce/ related subjects

After your Class 11-12 with any subject combination as per scheme of studies, study for an undergraduate degree in Business Administration / Finance / Banking/ Bank Management Banking and Financial Services / Economics/ Commerce/ related subjects. Now you can apply for the role of the analyst trainee in an investment bank.

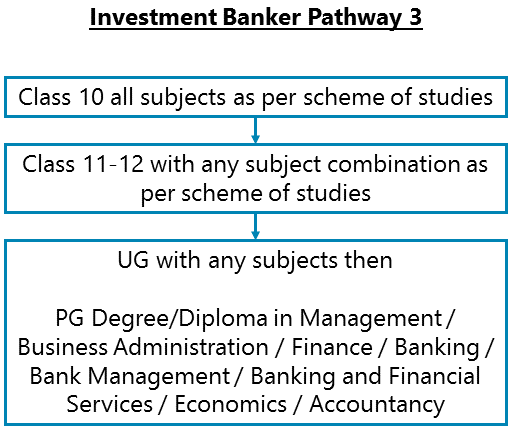

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies – UG with any subjects – PG Degree/Diploma in Management / Business Administration / Finance / Banking / Bank Management / Banking and Financial Services / Economics / Accountancy

After your Class 11-12 with any subject combination as per scheme of studies in your higher secondary school and then study for an undergraduate degree in any discipline. You may then go for a master’s degree or Post Graduate Diploma in Management / Business Administration / Finance / Banking / Bank Management / Banking and Financial Services / Economics / Accountancy.

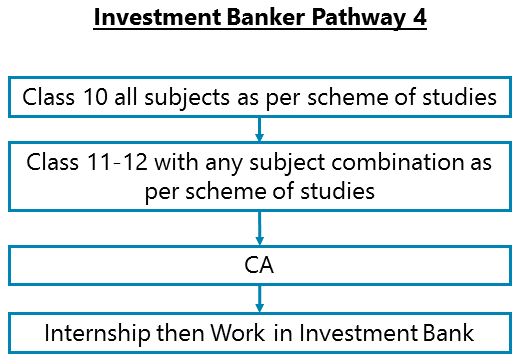

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies – CA – Internship – Work in Investment Bank

After your Class 11-12 with any subject combination as per scheme of studies, qualify for Chartered Accountant (CA) exam along with graduation or after graduation. Most people complete them after graduation. Then you can intern at an investment bank and then join as an analyst.

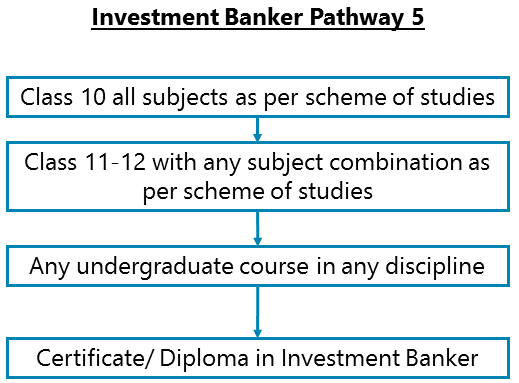

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies – UG in any discipline – Certificate/ Diploma in Investment Banker

After your Class 11-12 with any subject combination as per scheme of studies, study for an undergraduate degree in any discipline followed by a Certificate or Diploma in Investment Banker.

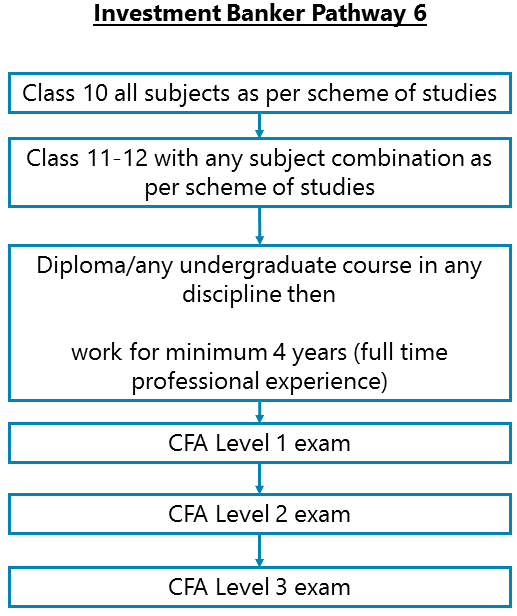

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies –Diploma/any undergraduate course in any discipline - work for minimum 4 years (full time professional experience) – CFA Level 1 exam – CFA Level 2 exam – CFA Level 3 exam

After completing Class 11-12 with any subject combination as per scheme of studies, you need to go for undergraduate studies/Diploma which may be in any discipline. Then you will have to work for 4 years at a full-time position in any professional field which may or may not be related to finance or investment decision making. Then you are eligible to apply for the CFA Program. It is a self-study program divided into 3 levels of exams and each exam is to be passed sequentially. You can continue work simultaneously while preparing for the CFA exams. CFA is the highest global distinction in the investment management profession. Level 1 exam is held twice a year in June and December. Levels 2 and 3 exams are held only once a year in June. There are as many as 11 test centers for these exams all over India. You will be provided the digital curriculum and study tools at the time of registration for each exam. CFA Institute’s ‘regular’ membership is a requirement to use the CFA designation anywhere in the world so you will have to apply for a ‘regular’ membership to the CFA Institute and this requires that you pass the Level 1 exam successfully and have minimum 4 years of professional work experience mandatorily related to the field of investment decision making. You will also need 2-3 professional references to apply for ‘regular’ membership.

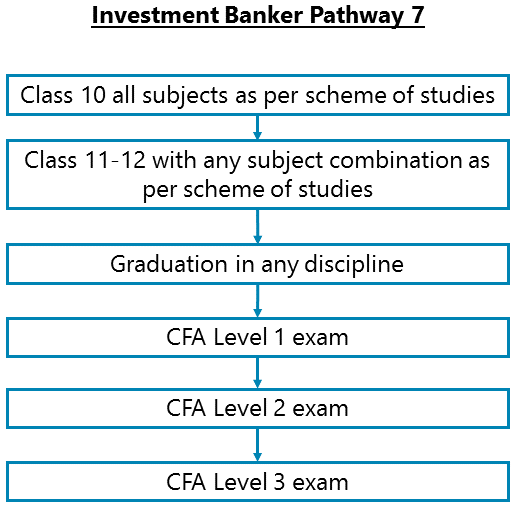

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies – graduation in any discipline – CFA Level 1 exam – CFA Level 2 exam – CFA Level 3 exam

After completing Class 11-12 with any subject combination as per scheme of studies, you need to go for graduation (Bachelor) degree program. Then you are eligible to apply for the CFA Program. It is a self-study program divided into 3 levels of exams and each exam is to be passed sequentially. You can also apply while you are in the final year of your Bachelor degree course and appear for the Level 1 exam. However, you will have to complete your degree course prior to applying to for Level 2. You can continue further studies or any job simultaneously while preparing for the CFA exams. CFA is the highest global distinction in the investment management profession. Level 1 exam is held twice a year in June and December. Levels 2 and 3 exams are held only once a year in June. There are as many as 11 test centers for these exams all over India. You will be provided the digital curriculum and study tools at the time of registration for each exam. CFA Institute’s ‘regular’ membership is a requirement to use the CFA designation anywhere in the world so you will have to apply for a ‘regular’ membership to the CFA Institute and this requires that you pass the Level 1 exam successfully and have minimum 4 years of professional work experience mandatorily related to the field of investment decision making. You will also need 2-3 professional references to apply for ‘regular’ membership.

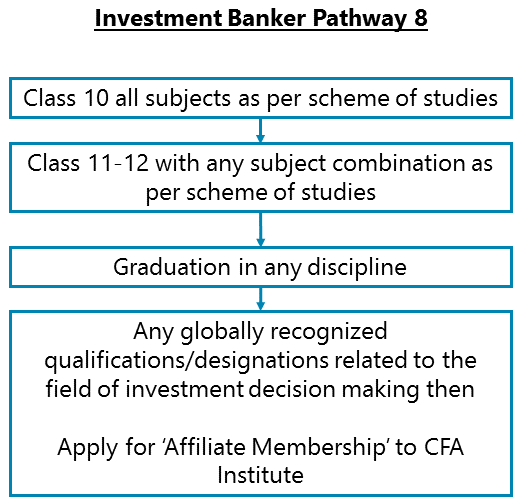

Class 10 all subjects as per scheme of studies - Class 11-12 with any subject combination as per scheme of studies – graduation in any discipline – Any globally recognized qualifications/designations related to the field of investment decision making – apply for ‘Affiliate Membership’ to CFA Institute

After completing Class 11-12 with any subject combination as per scheme of studies, you need to go for graduation (Bachelor) degree program. Then you may any globally recognized qualifications or designations such as ACA - Associate Chartered Accountant / ACCA - Association of Chartered Certified Accountants / CA - Chartered Accountant / CAIA - Chartered Alternative Investment Analyst/ CFP - Certified Financial Planner / CGMA - Chartered Global Management Accountant / CIIA - Certified International Investment Analyst / CIM - Chartered Investment Manager / CMA - Certified Management Accountant / CPA - Certified Public Accountant / FCA - Fellow Chartered Accountant / Etc. After acquiring any of the following qualifications you are eligible to apply for an ‘Affiliate Membership’ to the CFA Institute since a ‘Regular’ membership would additionally require you to go for the CFA program itself despite having any of these existing qualifications. You can use the CFA designation professionally along with the others only if you have a ‘Regular’ membership otherwise you can only call yourself an ‘Affiliate’ member of the CFA Institute.

Required Qualification & Competencies

Undergraduate studies after school

To become an Investment Banker, you can study any subject at undergraduate level. However, you can opt for an undergraduate course in Commerce or Business Management or Mathematics.

1. You can also opt for a CFA or CA courses.

2. CA is a statutory qualification in India for public accountants offered by the Institute of Chartered Accountants of India (ICAI). CFA is a globally recognised qualification for financial analysis offered by the USA based CFA Institute of Chartered and Financial Professionals.

Post Graduate studies

1. As the career of Investment Banking needs more knowledge of finance, marketing, and sales, it is recommended to take a Degree or Diploma course of 2 years in Business Management. You can specialize in Finance.

2. You can also opt for specialized diploma course in Investment Banking Financial Analyst etc. from banking institutes like Indian Institute of Banking and Finance, BSE, etc.

UGC has recently recognised the CA/CS/ICWA Qualifications as equivalent to Postgraduate Degree.

Competencies Required

You should have the following occupational interests:

Enterprising - You should have interests for Enterprising Occupations. Enterprising occupations involve taking initiatives, initiating actions, and planning to achieve goals, often business goals. These involve gathering resources and leading people to get things done. These require decision making, risk-taking, and action orientation.

Conventional - You should have interests for Conventional Occupations. Conventional occupations involve repetitive and routine tasks as well as fixed processes or procedures for getting things done. These occupations involve working more with data, systems, and procedures and less with ideas or creativity.

Following personality attributes are required:

1. You always or mostly prefer to stick within a routine or carry out routine and repetitive activities.

2. You are always practical or in most situations.

3. You are always or mostly disciplined in your action and behaviour.

4. You are always or mostly a soft-hearted person.

You should have the following skills and knowledge:

1. Communication skills - You should possess excellent communication skills, as you may have to work on project teams with various departments.

2. Reading Comprehension - Skills in understanding written sentences and paragraphs in work related documents.

3. Active Listening - Giving full attention to what other people are saying, understanding the points being made by others, asking questions, etc.

4. Critical Thinking - Skills in the analysis of complex situations, using logic and reasoning to understand the situations and take appropriate actions or make interpretations and inferences.

5. Judgment & Decision Making - Skills in considering the pros and cons of various decision alternatives; considering costs and benefits; taking appropriate and suitable decisions.

6. Administration - Knowledge of various administrative and operational functions in managing a business or an organization such as general administration, facility management, front office management, back office management, etc.

7. Accounting - Knowledge of various principles and methods for maintaining records of commercial and financial transactions and records, preparing various reports and statements, ensuring compliance with commercial and business laws and rules of a country, etc.

8. Economics - Knowledge of economic principles and practices; understanding how various resources such as land, labour, and capital are used; how market demands rise and fall; how a country collects and spends money; and similar other economic issues and situations.

9. Knowledge of managing a business which involves planning of what to do, Business Management -organising resources and people, leading and supervising work activities of people, and monitoring performances of people as well as the performance of the business. This includes knowledge of marketing, finance, human resources management, operations management, etc.

10. Customer Service - Knowledge about how to provide customer services. This includes understanding customer needs, helping customers to use products and services, answering customer queries, handling customer complaints and grievances, and evaluating customer satisfaction.

11. English Language - Knowledge about English grammar, words, spelling, sentence construction, using English to communicate with others, reading in English, etc.

12. Mathematics - Knowledge of arithmetic, algebra, geometry, calculus, trigonometry, statistics, and other mathematical disciplines and their applications.

You should have the following aptitudes and abilities:

1. Oral Comprehension - The ability to listen to and understand information and ideas presented through spoken words and sentences.

2. Oran Expression - The ability to communicate information and ideas in speaking so others will understand.

3. Written Comprehension - The ability to read and understand information and ideas presented in writing.

4. Deductive Reasoning - The ability to apply general rules and common logic to specific problems to produce answers that are logical and make sense. For example, understanding the reasons behind an event or a situation using general rules and common logic.

5. Inductive Reasoning - The ability to combine pieces of information from various sources, concepts, and theories to form general rules or conclusions. For example, analysing various events or situations to come out with a set of rules or conclusions.

Career - Job Opportunities & Profiles

1. Most of you will be working with either investment banks or the investment banking corporate division of any organization.

2. In the risk management side, you may also apply as a Risk Modelling Manager.

3. In the wealth management side of the career, you can join as an Assistant Portfolio Manager.

4. In the research side, you may start your career as Analyst or Management Trainee.

5. In the sales side, you will be joining as an Assistant Manager Sales.

Work Environment

Investment banking is a very work intensive career. As an investment banker, you will work in an environment that needs quick decision making, research, high intensity of work, long working hours and ready to face pressure. As it is about investment and money is involved, there is a high pressure of performance. At times, you will be travelling to meet your clients even in different countries.

Career Growth

If you join the risk management side as a Risk Modelling Manager, then you can become a Risk Director and then Risk Management Consultant and then finally VP of Market Risk.

In the wealth management, after joining as an assistant portfolio manager, you will become Relationship Manager, then you can become Team Leader and then Cluster Head of Wealth Management and then finally VP of Wealth Management.

If you are into research, then you can join as an analyst / Management trainee and then become Research associate. Later you can become a senior Business Analyst and then Consultant.

If you are into the sales side of the business, then after starting as the assistant sales manager, you will become Sales Manager, then you will be Senior Sales Manager and finally VP of Sales.

Salary Offered

1. At the entry level, you can start with a salary of Rs. 15,000 to 1,00,000 per month if you are in the research side. You may earn Rs. 50,000 to 2,00,000 per month on the sales side.

2. Risk Managers and others may earn around Rs. 30,000 to 1,50,000 per month. If you are a graduate from premier Business Schools like IIMs, you will be earning on the higher side.

3. At the junior level after 2-6 years of experience, you will be earning anywhere between Rs. 40,000 – 5,00,000 per month.

4. At the middle level of 6-12 years of work experience, your earning will rise to Rs 60,000-10,00,000 per month.

5. At the senior level after 12 years of work experience, your earning will be between Rs. 1,00,000 to 50,00,000 per month.

Future Prospects At A Glance

1. Entry level: 0 - 2 years of work experience

2. Junior Level: From 1 to 12 years of work experience

3. Mid-Level: From 5 to 20+ years of work experience

4. Senior Level: From 10 to 25+ years of work experience (there could be exceptions in some high-end technical, financial, engineering, creative, management, sports, and other careers; also in the near future, people will reach these levels much faster in many careers and in some careers, these levels will have no meaning as those careers will be completely tech skill driven such as even now, there is almost no level in a Cyber Security Expert’s job)

Work Activities

As an Investment Banker, you might be involved in various applied areas of Investment Banking. In these areas, you might be involved in different activities such as:

Using computers for work - Using computers for day-to-day office work; using computer software for various applications in day-to-day professional work; entering data and process information; for writing.

Analysis and interpretation of data and information - Analysis of data and information to find facts, trends, reasons behind situations, etc.; interpretation of data to aid in decision making.

Getting Information and learning - Observing, hearing, reading, using computers, or otherwise obtaining information and learning from it.

Decision making and problem-solving - Analysis of data and information; evaluation of alternative decisions and results of decisions; taking the right decisions and solving problems.

Information processing - Searching, compiling, tabulating, calculating, auditing, verifying or otherwise dealing with information processing including data entry, transcription, recording, storing and maintaining databases

Future Prospects

Investment banking is gaining prominence in India due to rising income and thus increase in savings (as per if report). The mutual fund's industry stood at Rs. 24.03 trillion in India in 2018. In 5 years, this will see 4 times growth to nearly Rs. 95 trillion. Even the insurance industry has seen a peak in recent time. In 2018, the first-year premium of life insurance reached USD 30.10 billion. The amount of money raised through IPO was over USD 1.2 billion in 2018. Money raised in mergers and acquisitions in 2018 was USD 4.16 billion. India has been number one in FDI investment for the last 4 years. These auger will work for someone interested in investment banking.

Future Prospects At A Glance